Bitcoin

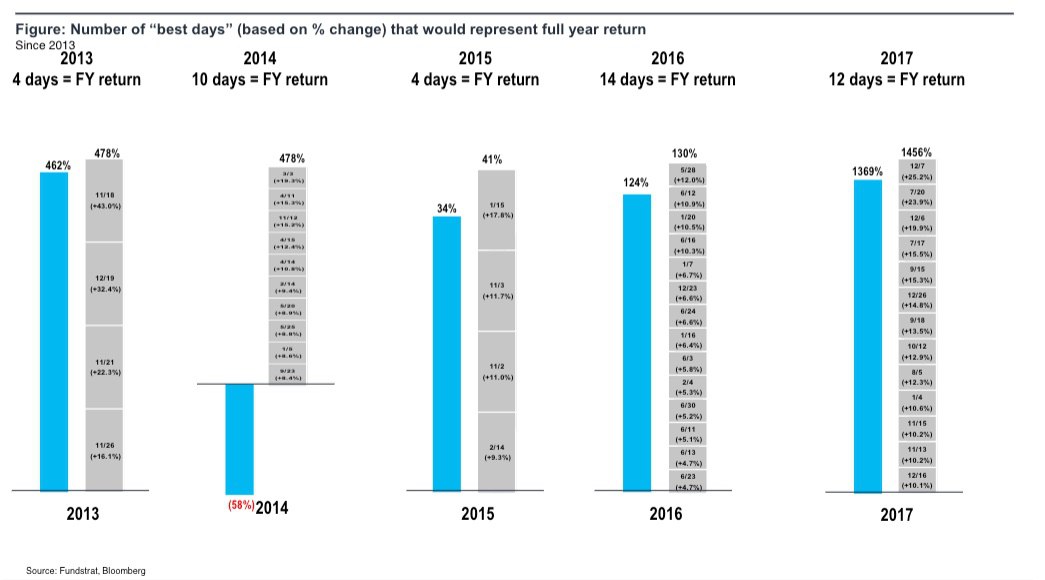

There Were 12 Good Days to Hold Bitcoin Last Year

With Digital Currency markets under serious pressure, while US Regulators sort through the thoughts about ICOs, some are wondering if now is the time to sell. While investors should only invest the amount of money that they’re ok to lose, getting out to try and time a market reentry is a risky strategy. Over the past few years, there have been only a handful of days that accounted for the largest Bitcoin gains:

It’s good to note that this pattern has applied to other financial markets, including the S&P 500. Unless the goal is to be a trader, which is a skill in itself, those that feel bullish about the long term prospects of a Digital Currency should hold through thick and thin, so that they don’t miss out on the “best days.”

When it comes to adding to a position, one strategy people use is dollar cost averaging. Basically, this means buying the same amount of a particular investment on a fixed scheduled (say $100 every Monday). This allows you to average the prices across highs and lows and keep a cost basis somewhere in the middle. Over time, this may stop you from making your entire investment at the top of the market, while still giving you some exposure to buying the lows. If nothing else, think of it as a risk management tool (and risk is high in these markets!).

To some, these strategies may seem rudimentary, but there are plenty around the US, the World, and the internet in general who were not Finance majors or have even taken basic Financial literacy courses.

Keep the above graphic in mind next time you’re trying to guess the markets because you don’t want to miss out!

Disclaimer: The authors of this article are not investment professionals and nothing in the above should be construed as investment advice.

binance sign up

June 3, 2023 at 6:42 PM

Your enticle helped me a lot, is there any more related content? Thanks! https://accounts.binance.com/en/register-person?ref=P9L9FQKY