Opinion

Responsible Sharing in a World of Fake News

We live in a world of feeds and headlines. In the time it takes to click on an article, read it, and full analyze, we could look at 1,000 other tweets. Therefore, it is easy for sensational statistics and poorly defined terms to spread as truth.

A recently released study by the Satis Group made its way around Twitter using a sensational headline: “81% of ICOs are Scams” (important note for this article: an “ICO” is a funding event and that term should not be used to describe a token or coin that you buy on an exchange). Readers, I want to ask you a favor — when you see a headline like this, please read on before you retweet or share data with others.

The original tweet has since been deleted, but the content has been repurposed by many, including New York Times Journalist, Nathaniel Popper (who thankfully did further research rather than just retweeting):

since tweeting this, i've heard that @ccatalini's team at MIT has looked into ICOs and gotten very different numbers: somewhere between 5 and 25% of ICOs are frauds. he hasn't published his full research, but will be interesting to see what accounts for the difference

— Nathaniel Popper (@nathanielpopper) March 26, 2018

In reading the actual report, Satis Group actually does a good job of defining their methodology. They define a “Scam” as an ICO that is not exchange traded and:

Any project that expressed availability of ICO investment (through a website publishing, ANN thread, or social media posting with a contribution address), did not have/had no intention of fulfilling project development duties with the funds, and/or was deemed by the community (message boards, website or other online information) to be a scam.

To this definition, investor Anthony Pompliano commented:

The definition of scam here is absurd and very inaccurate. Relying on message boards screaming “SCAM!” as the bar would make Uber, Lyft, Facebook and Amazonall scams too ?

— Pomp ? (@APompliano) March 26, 2018

This study did ok to prove a certain point, but when the messaging and methodology is flawed, it can do major damage on a platform, like Twitter, that rewards clickbate headlines.

What the Study Did Well

It’s ok to use research to warn the public about the risky nature of ICOs. ICOs are risky… People have lost money in ICOs that turned out to be fraudulent. It takes a lot of research to make any investment decision and ICOs are no different (please DYOR — Do Your Own Research).

What Went Wrong

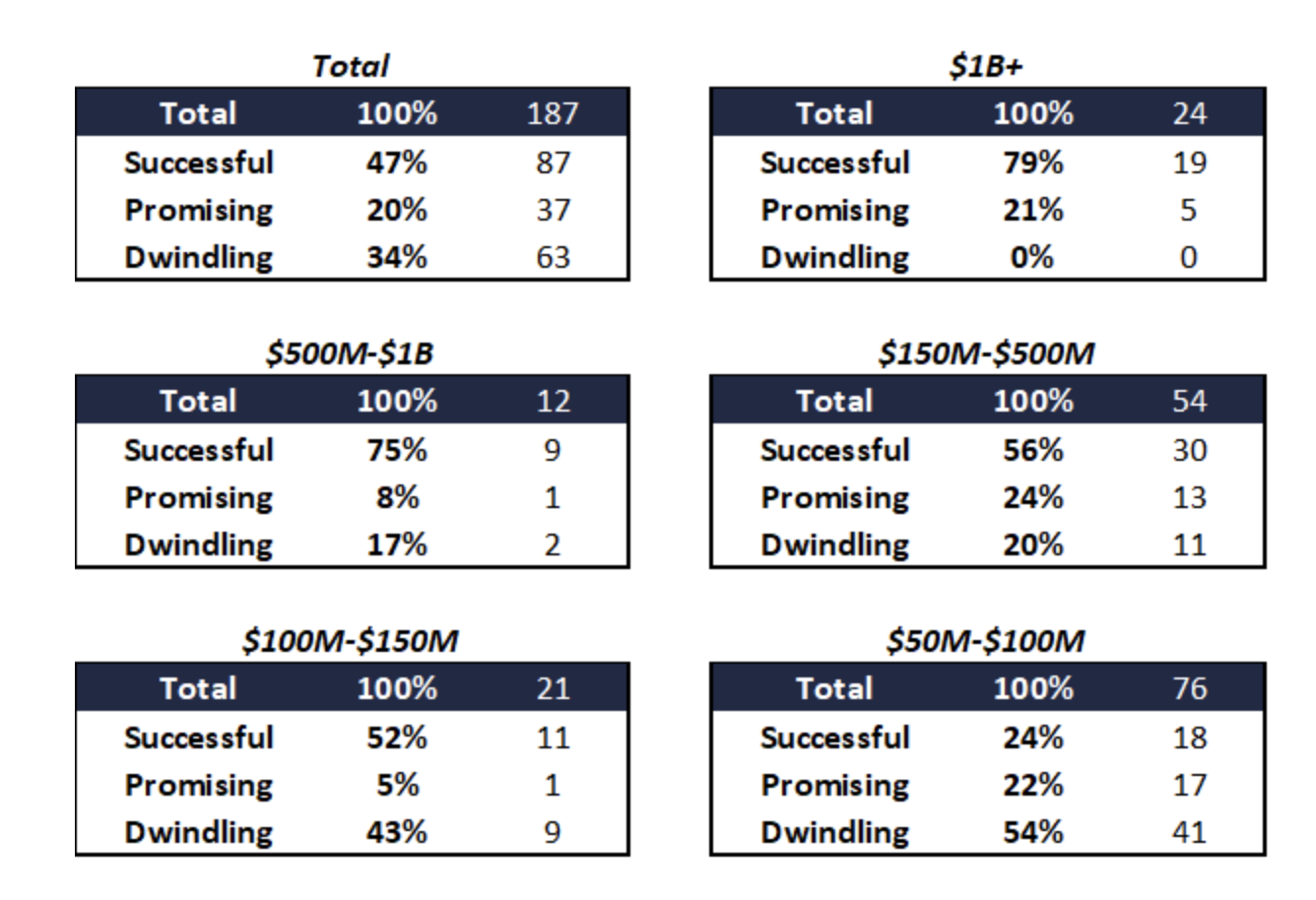

Communication in a 240 character world. The first thing that was not made clear in headlines is the important distinction between an ICO whose coin gets traded on an exchange and one that does not. In fact, once you look at exchange traded coins with at least a $50M Market Capitalization, the data tells a very different story:

DYOR and be safe out there.

Pingback: What We've Heard About the SEC's Ethereum Meeting

binance

June 17, 2023 at 5:25 PM

Your article helped me a lot, is there any more related content? Thanks! https://www.binance.com/ka-GE/register?ref=V3MG69RO